CANSLIM Growth Investing and the Biggest Gainers of 2020

Every year there are stocks that smash the performance of the overall market. Typically flying under the radar, these names quietly execute quarters of triple-digit revenue growth and exploding sales. Before a big run-up in share prices happens, these stocks almost always display the same patterns of accelerating profits, an increase in institutional ownership and chart action that signals frenzied buying from a pivotal break-out point.

These market leading growth stocks appear quarter after quarter and will continue to do so. Finding a way to catch them from their early stages can provide significant profits. The CANSLIM method helps us do so. Created by legendary investor William O'Neal, this acronym stands for a set of rules for buying these growth names. In addition to basic fundamentals like increasing YoY quarterly revenue growth and increasing EPS, stocks under the CANSLIM criteria must also display strong technicals such as uptrends and new all time highs.

The best way to find and capture the next batch of explosive growth stocks is to study the ones that occured most recently. The clues and events leading up to the previous huge runs are being seen right now in this quarters earnings reports.

Below are 15 of 2020's biggest gainers, all of which were fueled by accelerating revenues. Take note of the CANSLIM fundamentals such as Year-Over-Year revenue growth and increasing EPS. Much can be learned by simply observing the growth % numbers along with recognizing the chart patterns displayed before the big break-outs occured. These patterns repeat themselves over and over again. Recognizing the patterns and combining that knowledge with basic understandings of revenue growth can create a very profitable trading strategy.

My biggest take aways;

1) stocks in uptrends seem to almost always increase 50-100% following the first quarter that sees YoY revenue cross 70+ %

2) stocks almost always increase 50-100% following three consecutive quarters of increasing YoY revenue that is above 70%

* Note: If anything looks unfamiliar or confusing, hop on over to the "Basics/How to" section to see a detailed explanation of my charts.

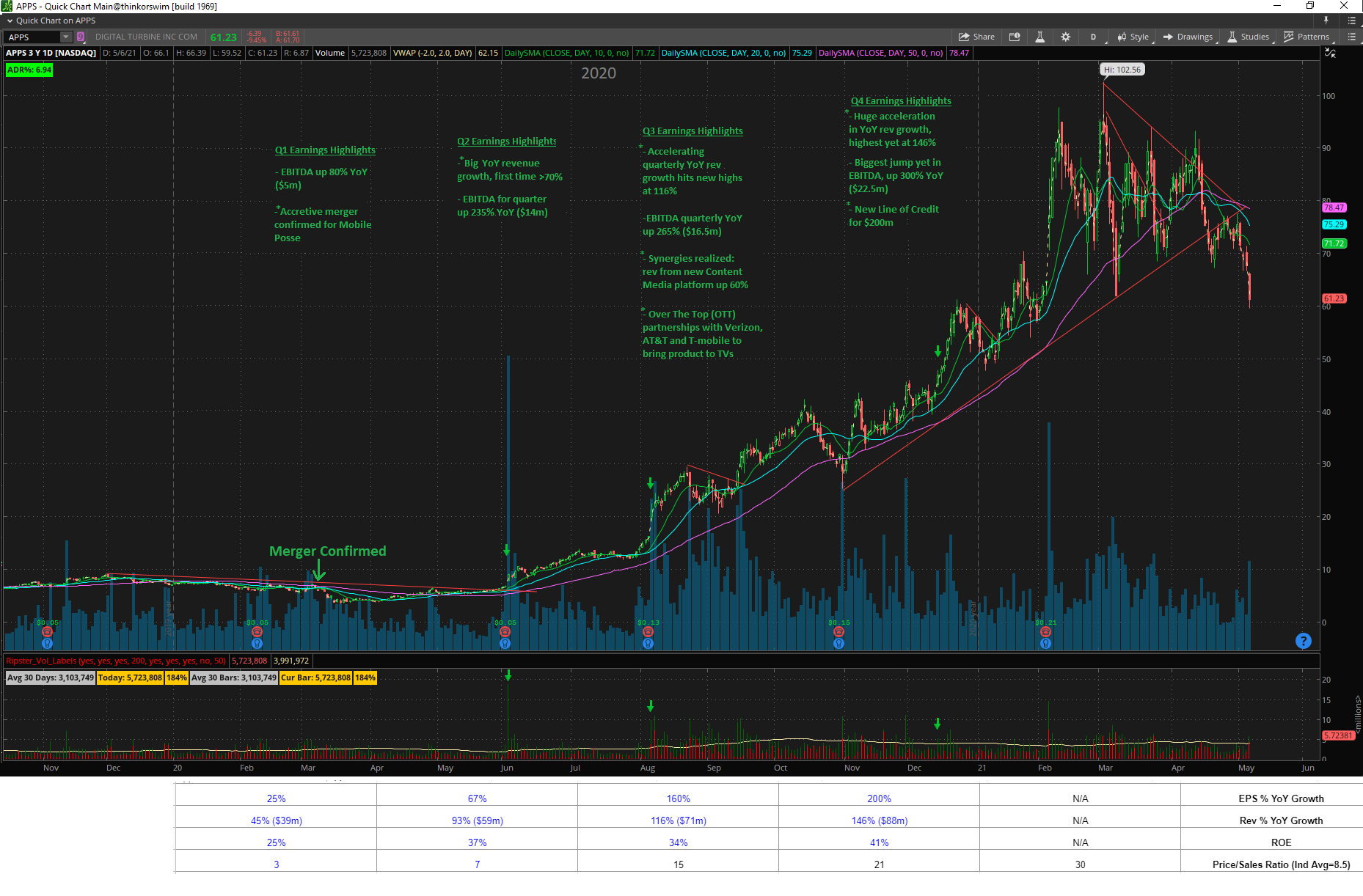

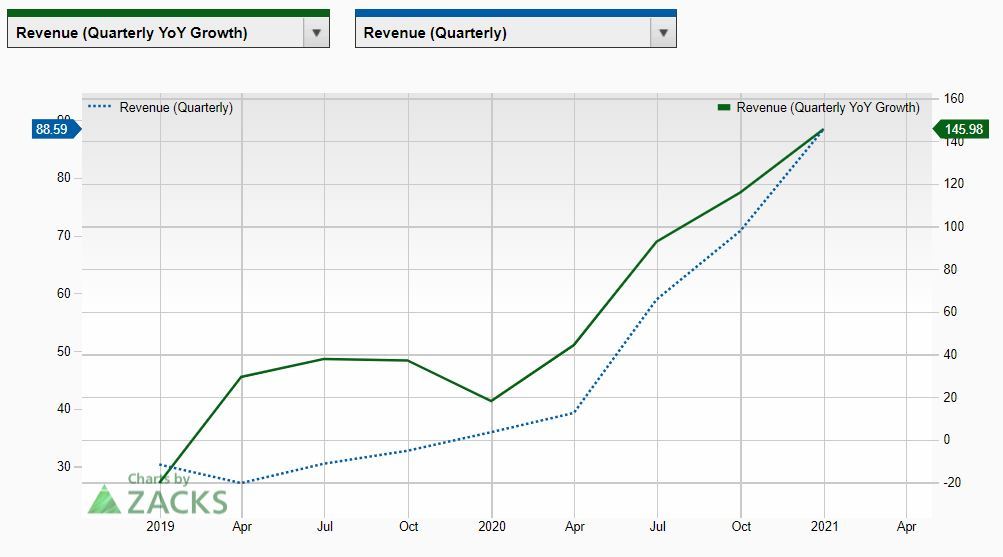

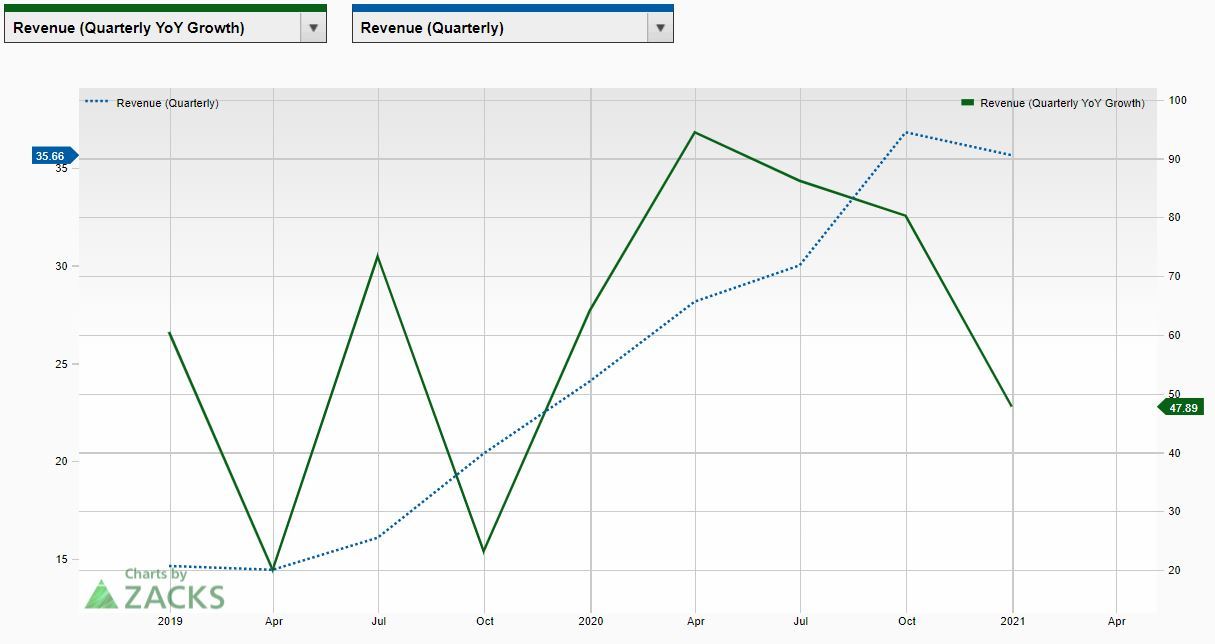

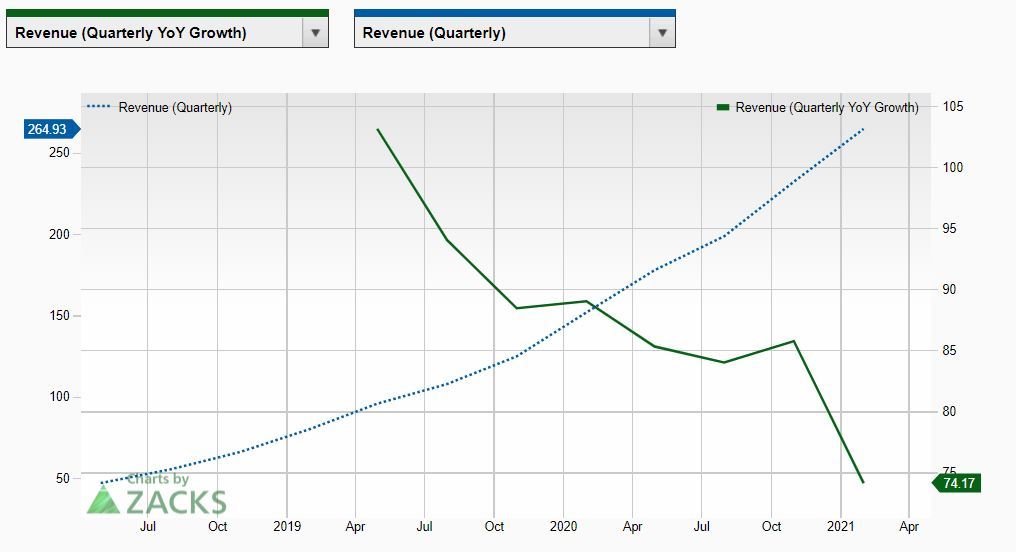

APPS

750% Gain (1st buy signal to peak)

Digital Turbine is a middleman between Original Equipment Manufacturers (OEMs) and advertisers/app makers who put apps onto phones. The company negotiates placement fees for those looking to have their apps pre-loaded onto new phones. Digital Turbine then collects the money, gives ~60% to the OEM, then keeps the rest. Currently, over 40 mobile OEMs and 2,000 advertisers work with Digital Turbine, bringing the number of devices with it's tech up to 575 million.

The financials of this company have been incredibly strong. The first two quarters were solid, reporting EBITA up 235% YoY along with increasing YoY revenue above 70%. The acquisition of Mobile Posse in Q1 for its content media platform turned out to be profitable almost immediately. Earnings from the last two quarters were exceptional, reporting accelerating triple-digit YoY revenue and EPS growth: this is something that is rarely seen. In addition to sales and revenue growth, an ROE of 44% signals an extremely efficient and profitable business. Revenue Per Device (PRD) increased 25% in the US and 50% internationally. This would suggest that platform network effects are working. In addition to the growth of its mobile operations, in the second quarter the company announced its plans to move into the world of Over The Top (OTT) TV streaming, essentially bringing the same model to the world of smart TV's. Then, AT&T, Verizon and T-Mobile were announced as partners to make this vision happen.

Digital Turbine has proven to be insulated from the pandemic, a determining factor of many of the names in this study. The company appears to have created a moat, as its competitors continue to lag behind while Digital Turbine's margins keep increasing. Mergers, expansion from mobile to TV streaming, extreme revenue growth and high profitability appear to have been the primary drivers of Digital Turbine's massive 2020 run.

CELH

775% Gain (1st buy signal to peak)

CRWD

180% Gain (1st buy signal to peak)

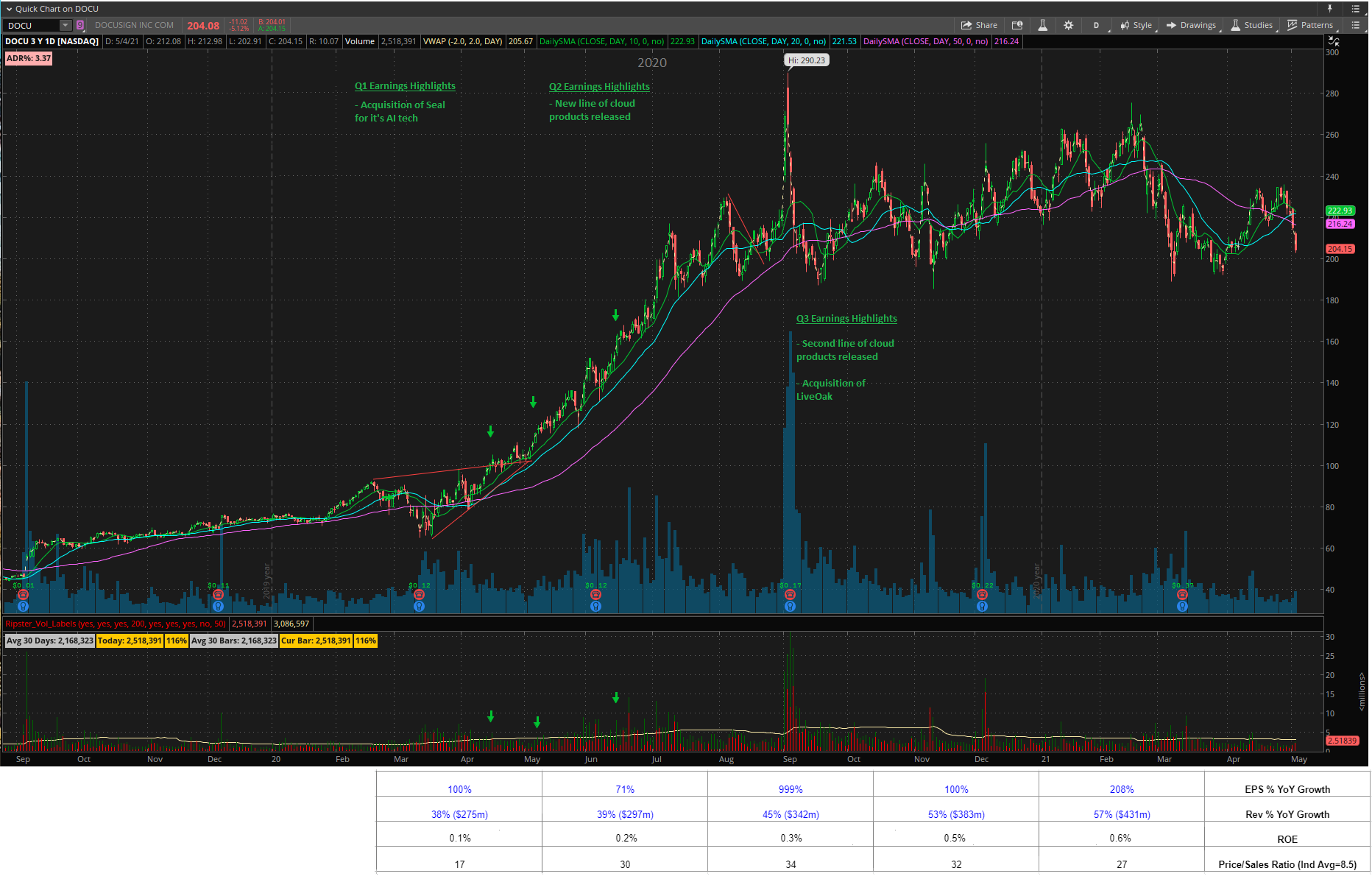

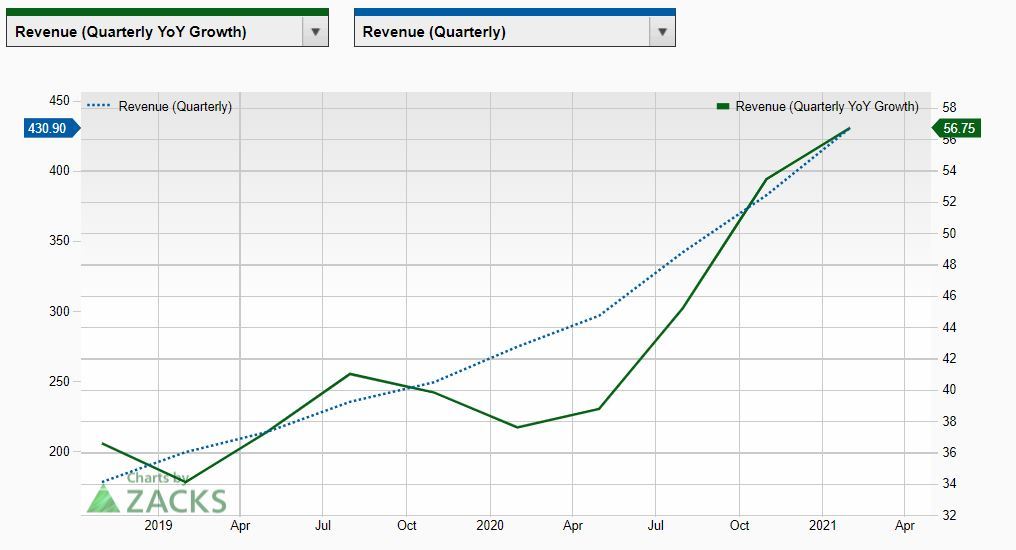

DOCU

190% Gain (1st buy signal to peak)

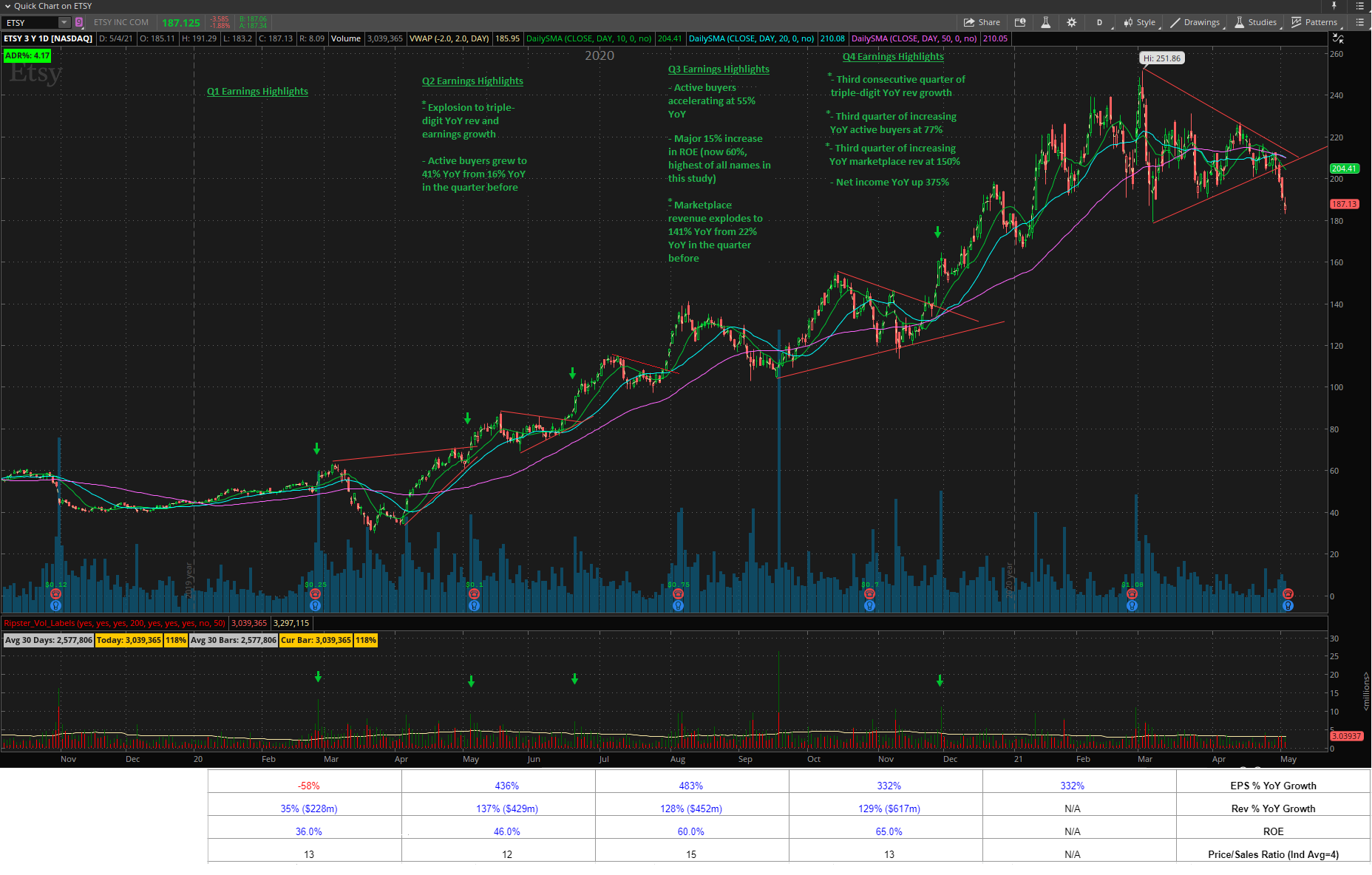

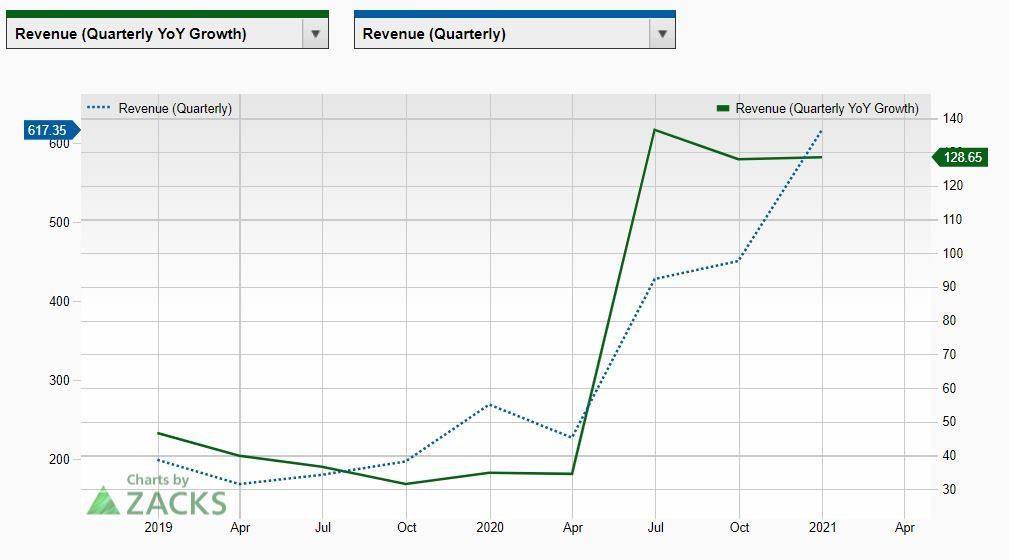

ETSY

320% Gain (1st buy signal to peak)

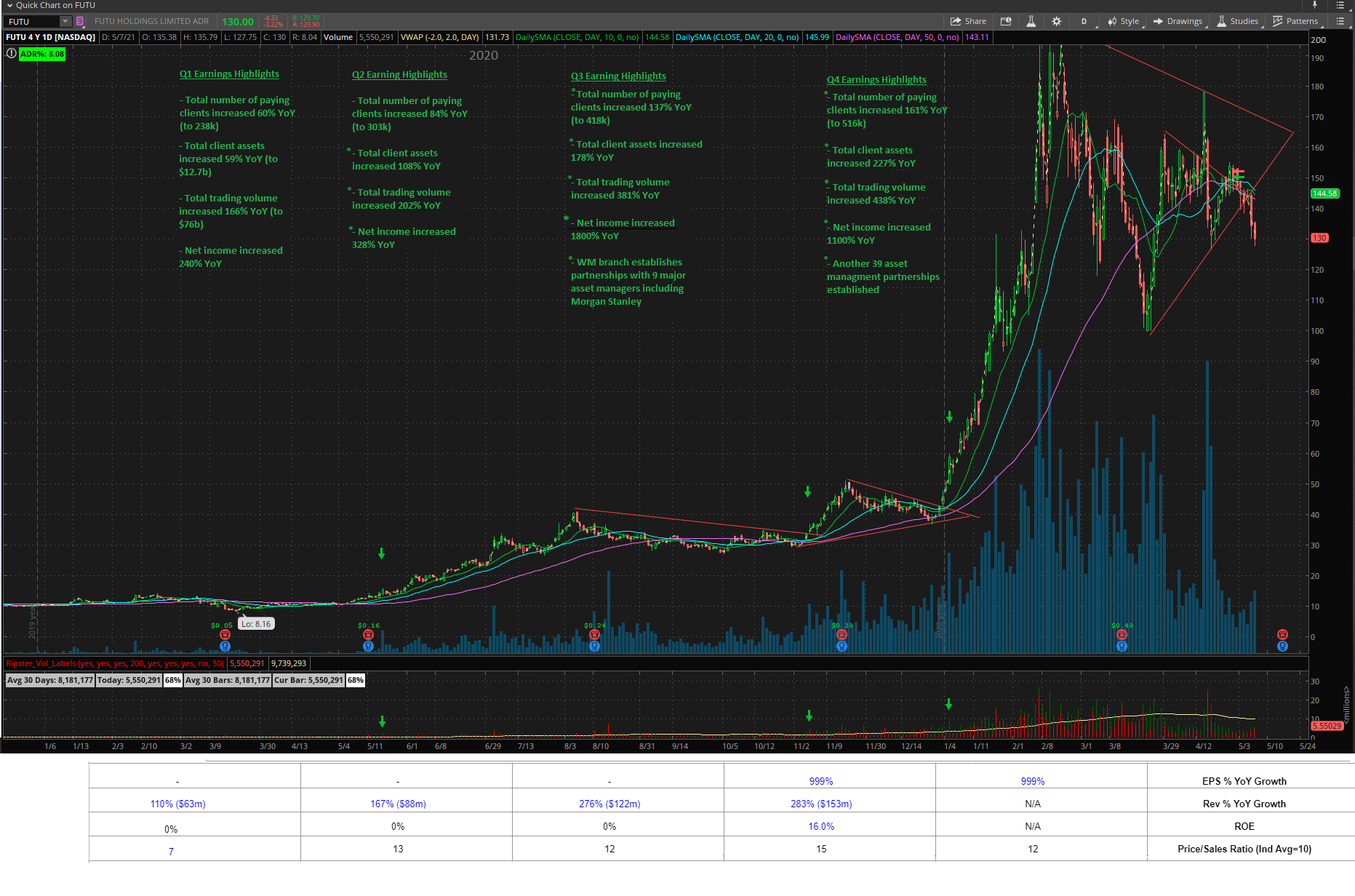

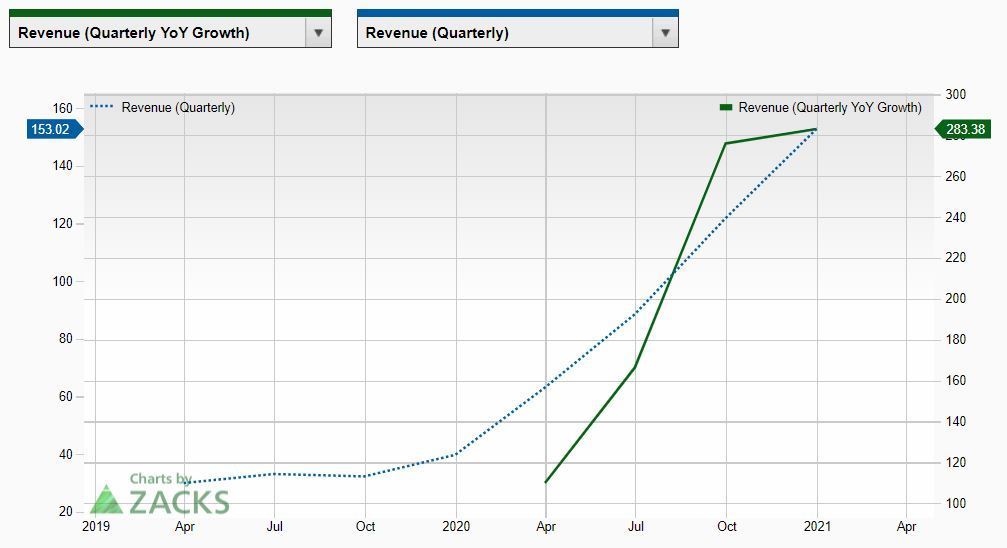

FUTU

340% Gain (1st buy signal to peak)

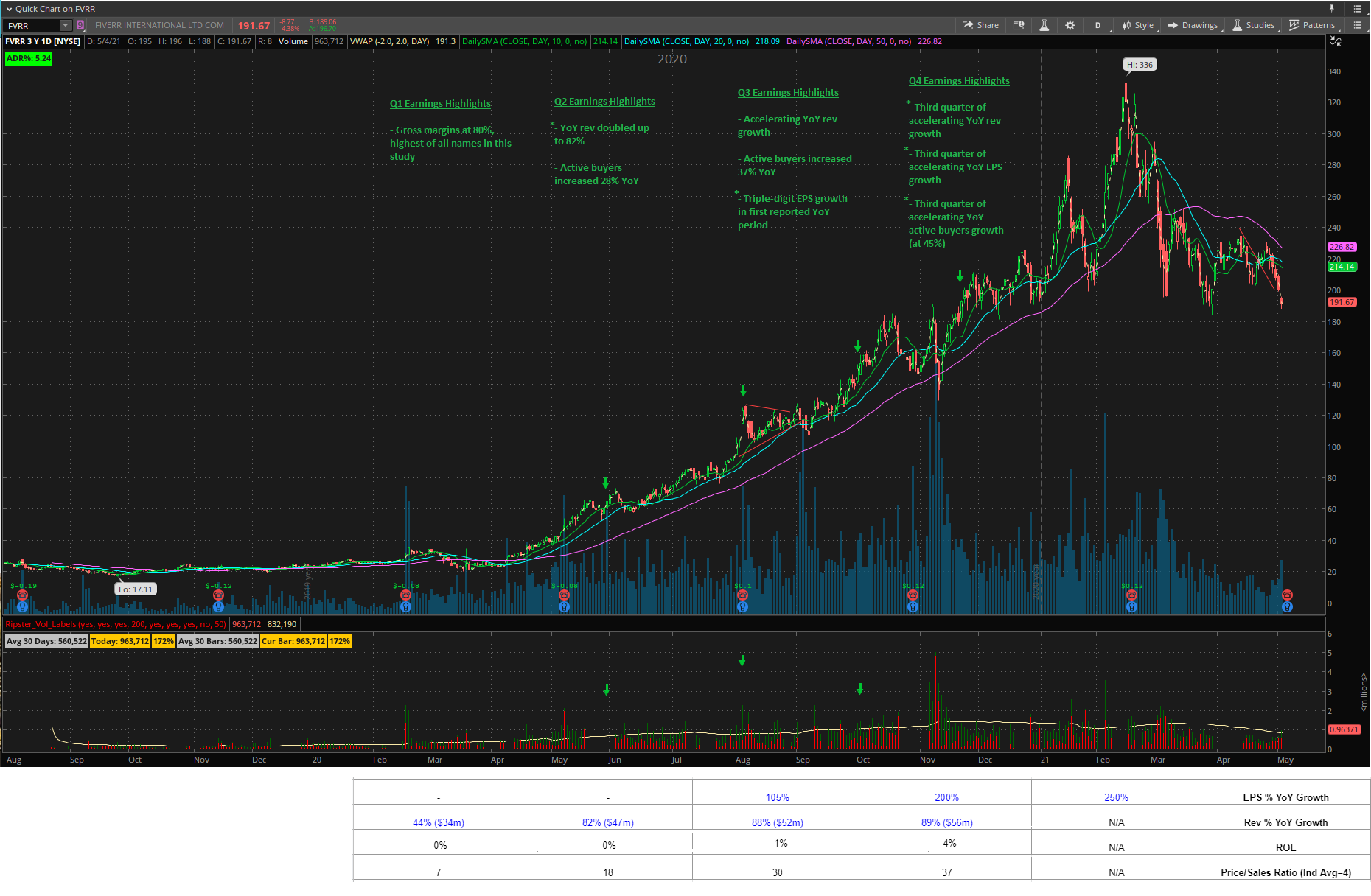

FVRR

380% Gain (1st buy signal to peak)

GRWG

345% Gain (1st buy signal to peak)

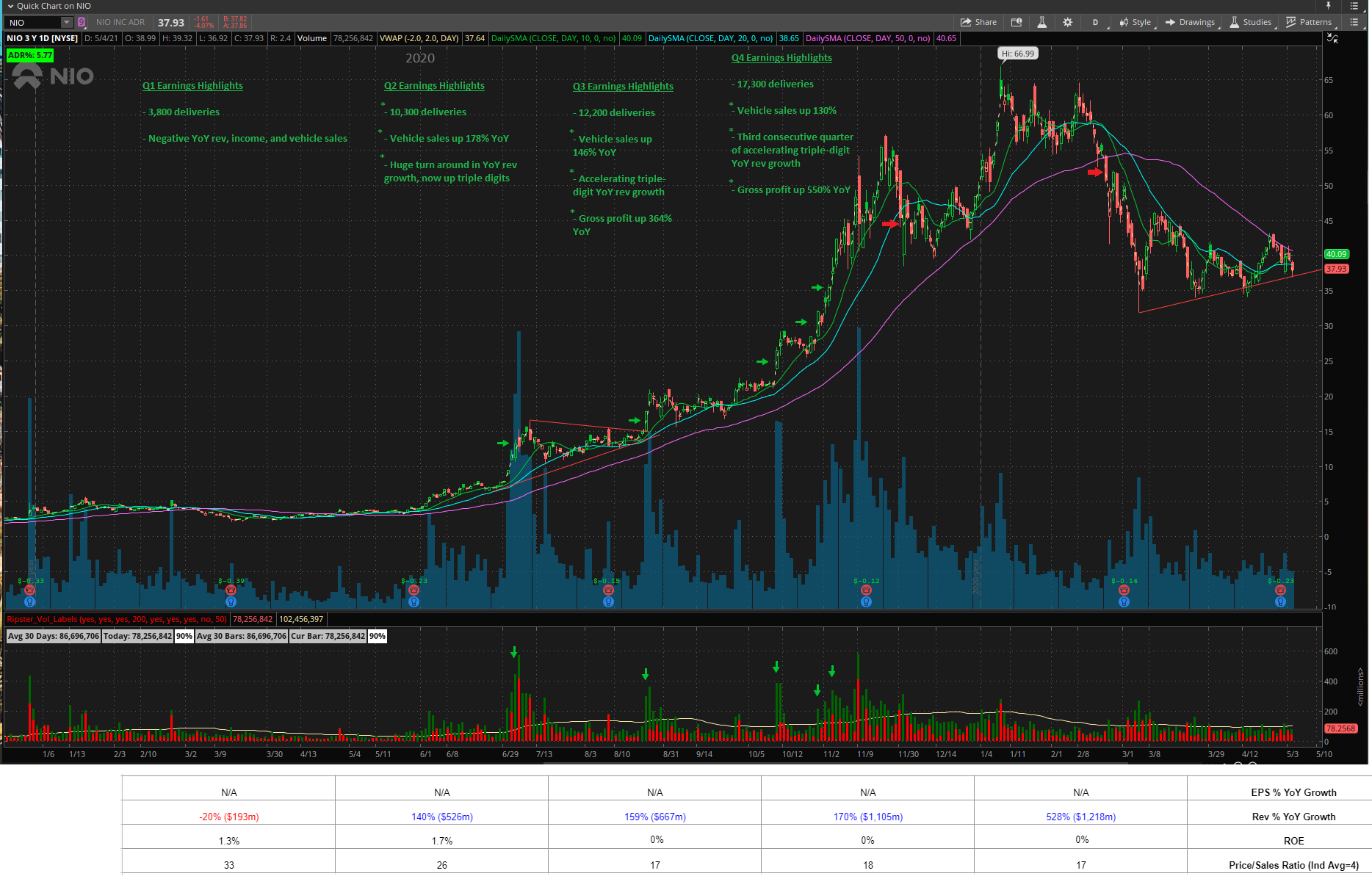

NIO

408% Gain (1st buy signal to peak)

PTON

307% Gain (1st buy signal to peak)

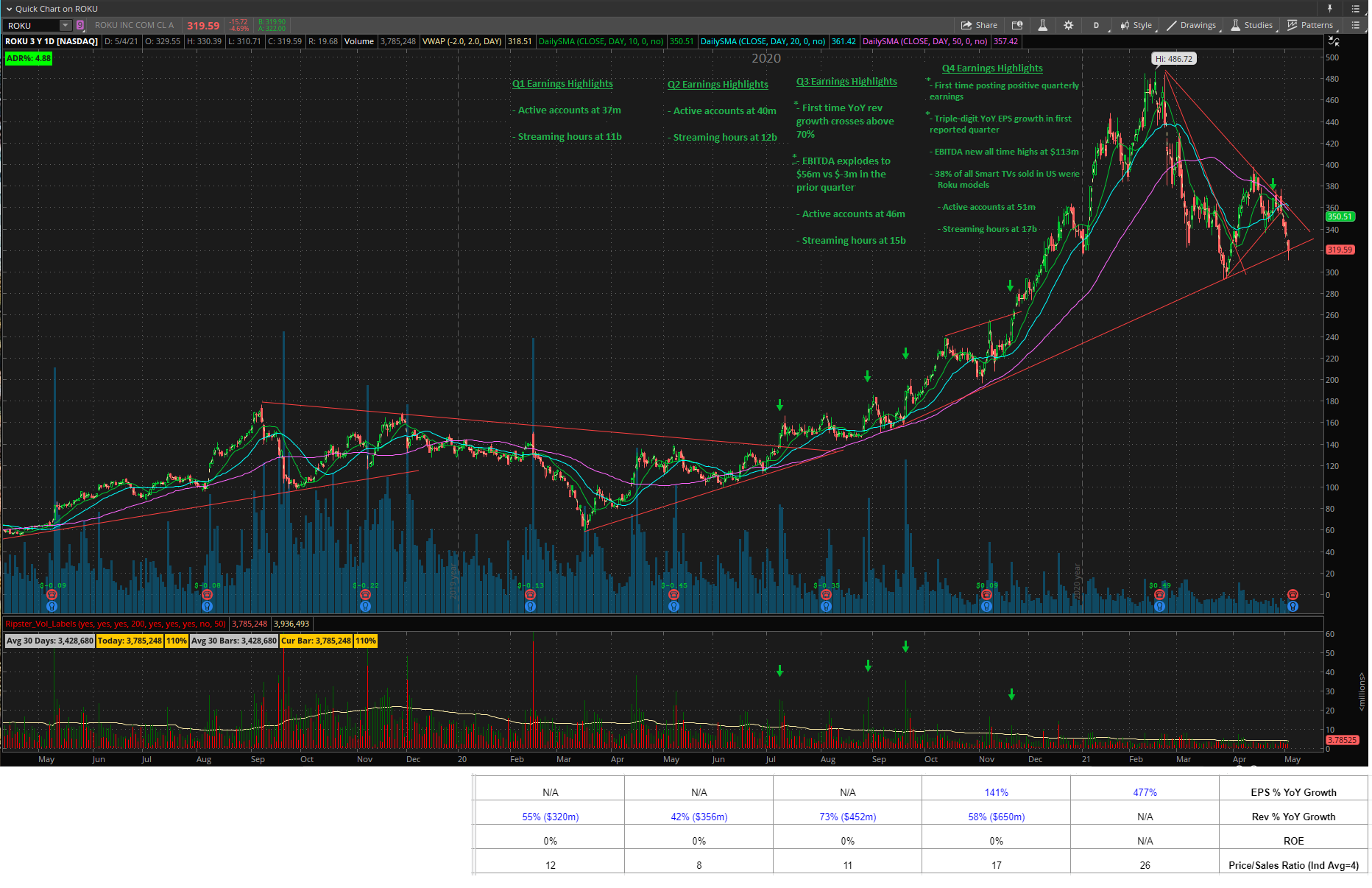

ROKU

210% Gain (1st buy signal to peak)

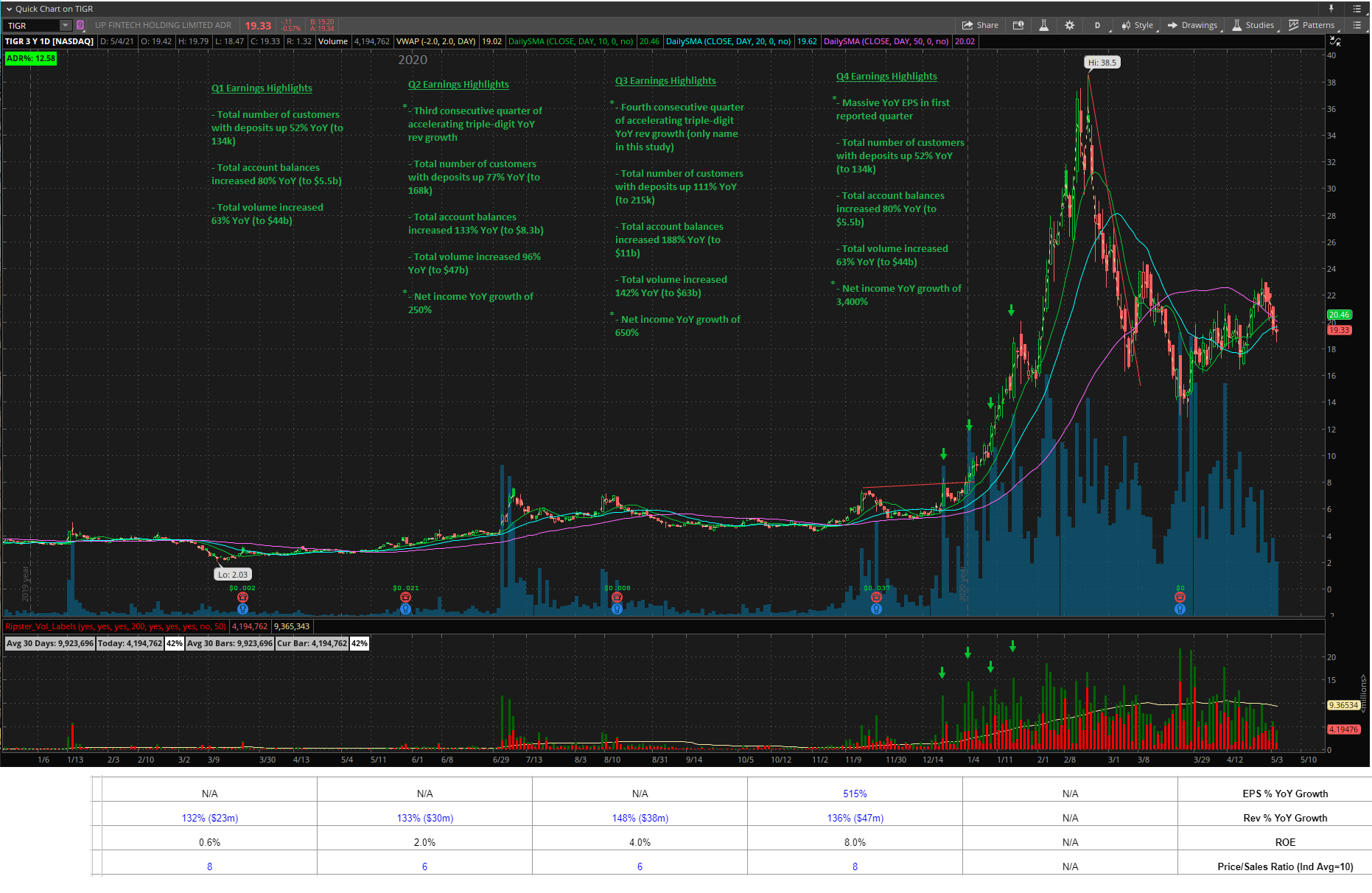

TIGR

540% Gain (1st buy signal to peak)

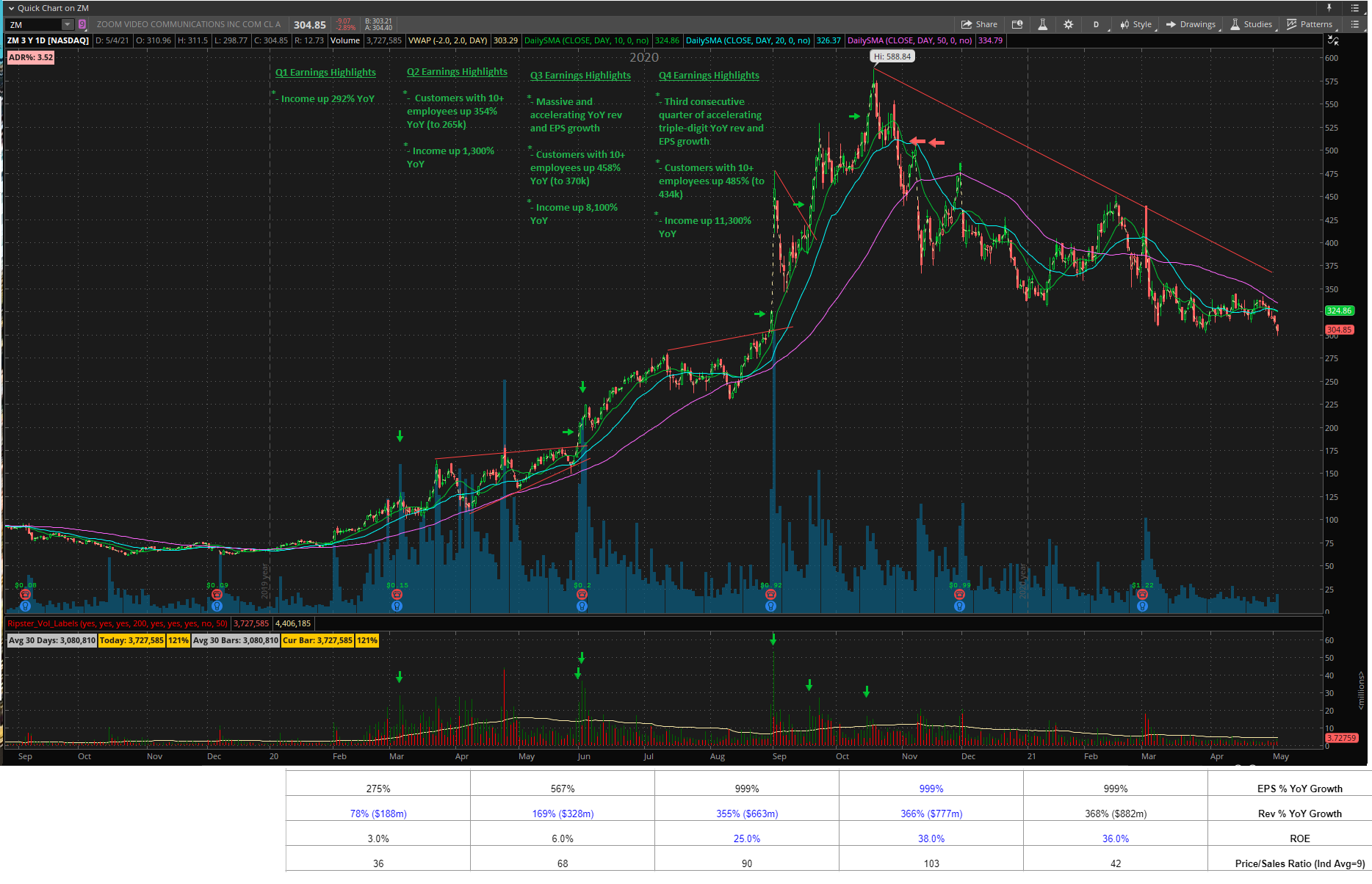

ZM

370% Gain (1st buy signal to peak)

ZM